April 14, 2021

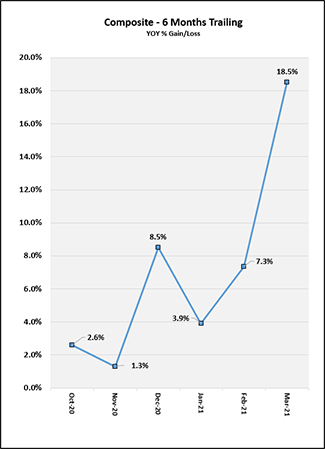

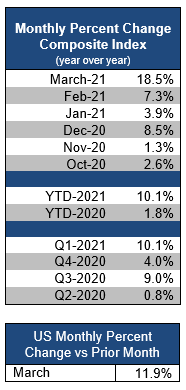

U.S. life insurance application activity soared in March with Year-over-Year (YOY) activity up +18.5% and Year-to-Date (YTD) activity up +10.1%, representing the highest gains in each category for any month since before 2018, according to the MIB Life Index. Q1-2021 ended up +10.1% over Q1-2020, representing seven (7) consecutive quarters with Quarter-over-Quarter (QOQ) gains and the highest QOQ gain on record. While the difference in YOY activity can be somewhat attributed to the early effects of COVID in 2020, activity for March 2021 surpassed results for March 2019 (+21.6%) and 2018 (+13.8%).

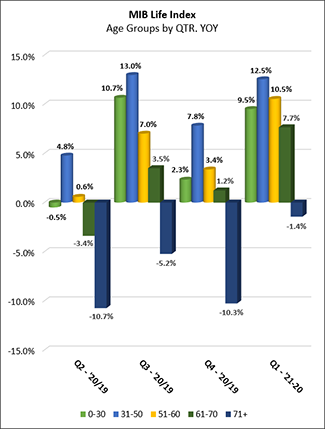

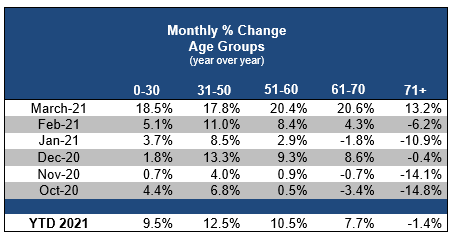

All age groups experienced double-digit growth in March YOY, including ages 70+ which had seen consistent YOY declines throughout the pandemic, starting in March 2020. March 2021 also saw the second consecutive month in which all age groups experienced Month-Over-Month (MOM) increases.

On a quarterly basis, all age groups up to and including age 70 experienced growth in Q1-2021 over Q1-2020, with double-digit growth among ages 31-60. Ages 71+ in contrast saw slight declines QOQ. Since COVID-19 affected Q1-2020 results, it is worth noting that all age groups experienced growth for Q1-2021 compared to Q1-2019, including double-digit growth for ages 0-50.

March saw the second consecutive month in which MOM increases were experienced across all face amounts. YOY for March and QOQ for Q1 both saw aggregate growth across all face amounts in the double-digits, with the largest growth in face amounts over $5M. When examining age bands QOQ, ages 0-60 saw growth across all face amounts, nearly consistently in the double digits. Ages 61-70 saw double-digit growth in face amounts up to, including $250K, and above $5 M. While ages 71+ saw growth in amounts up to and including $250K and declines in all other categories.

All product types had double-digit YOY growth in March with Whole Life experiencing the highest percentage of growth (+24.4%), Universal Life second (+20.9%) and Term Life third (14.8%), in a pattern that was seen consistently in aggregate and across all age bands. On a quarterly basis, double-digit growth was also seen across all product types when comparing Q1-2021 to Q1-2020 and aggregating age bands. When breaking down results by age, all age bands experienced growth in all product categories QOQ, however, ages 31-60 had consistent double-digit growth across all product types, ages 0-30 had double-digit growth for Universal Life and 61-70 had double-digit growth for Whole Life.

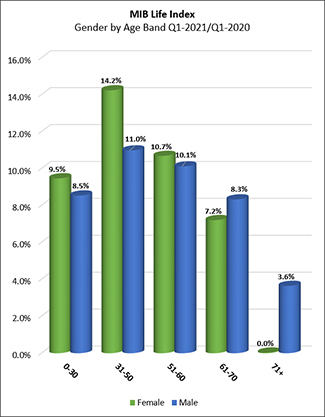

For our Q1 report, we are including an analysis on application activity by gender. Growth in activity was slightly higher for females over males both on a YOY basis for March (+19.3% and +17.4%, respectively) and a QOQ basis for Q1 (+10.7% and +9.6%, respectively). When looking at age bands, we noticed a relative increase in applications by females over males ages 0-60 for Q1-2021 vs Q1-2020 as well as an increase in male application activity over female for those over age 70.

Methodology Change for 2021: MIB has changed the way we report trends in application activity. Effective immediately, variations with industry activity reflect a straight period over period percent changes (YTD, YOY, MOM, and QOQ) based on calendar days vs. the prior methodology based on a 2011 baseline index on a business day calculation.

Contact: Betty-Jean Lane, MIB Group, Inc., 781-980-0017, BLane@mib.com