April 19, 2021

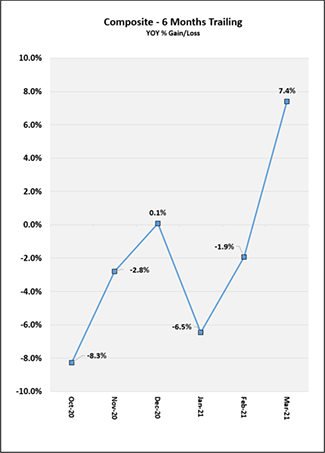

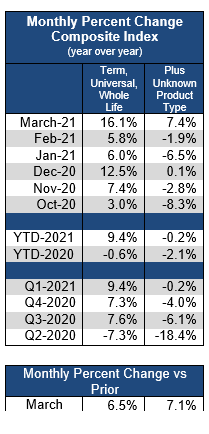

Canadian life insurance application activity achieved record growth in March with Year-over-Year (YOY) activity up +7.4%, representing the highest gain for any month on record, according to the Canadian MIB Life Index. The positive trends in March bring Year-to-Date (YTD) activity for Q1 to a flat -0.2%, reversing the trend of declines of -2.0% or more on record since the beginning of 2018. While the difference in YOY activity can be somewhat attributed to the early effects of COVID in 2020, activity for March 2021 is also higher than March 2019 by +5.1%.

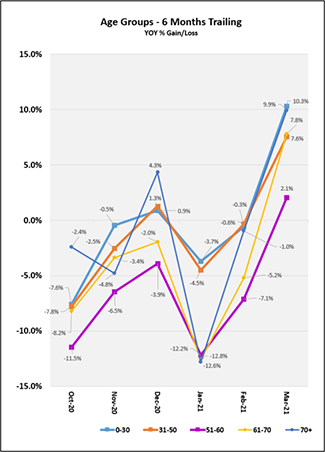

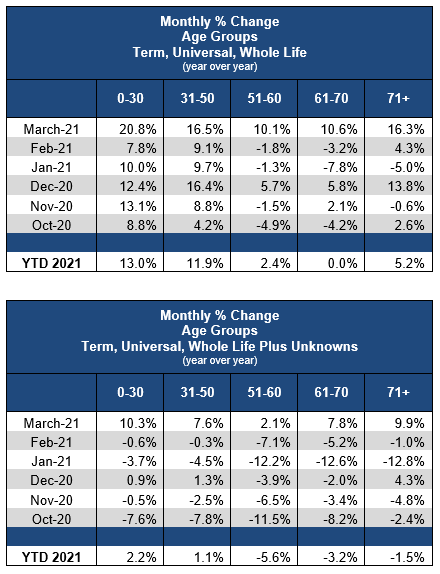

All age groups experienced YOY increases in March, ranging from +2.1% to +10.3%. While activity across age bands has fluctuated, this is the first month since September 2019 that all age bands had positive YOY growth. Quarter-over-Quarter (QOQ), activity had a slight increase for age 0-20 at +2.2%, was generally flat for ages 31-50 at +1.1%, decreased for ages 51-60 at -5.6% as well as ages 61-70 at -3.2% and was relatively flat for ages 71+ at -1.5%.

March YOY growth was driven by face amounts up to and including $2.5M and over $5M, with the highest gain for face amounts between $500K up to and including $1M at +16.2%. Face amounts up to $250K and over $5M also showed double digit growth at +10.4% and +13.1%, respectively. When looking at age bands, results were mixed. Ages 0-30 increased in double digits YOY for amounts up to and including $1M and also for amounts over $5M, but had double digit declines for face amounts over $2.5M up to and including $5M. Ages 31-50 grew across all face amounts YOY with double digit growth for face amounts over $250K up to and including $2.5M and also for amounts over $5M. Ages 51-60 had growth for face amounts up to and including $250K, and also for amounts from $500K up to and including $2.5M with declines in all other categories. Ages 61-70 saw double digit growth for face amounts up to and including $250K as well as over $5M and double digiit declines for amounts over $250K up to and including $500K, as well as amounts over $2.5M up to and including $5M. Ages 71+ had double digit growth for amounts up to and including $250K, over $500K up to and including $1M, and for amounts over $5M. Age 71+ also saw double digit declines for amounts over $250K up to and including $500K and amounts over $1M up to and including $2.5M.

When examining activity patterns where a product type was submitted to MIB, we see growth across the board with Term Life up 4.1%, Universal Life up +48.6% and Whole life up +26.7% as compared to March-2020 submissions. For younger ages 0-30, Term dropped in the double digits in favor of Universal Life which grew in the triple digits and Whole Life which grew in double digits. For ages 31-60, there was growth across all products with double-digit growth for Whole Life and for ages 31-50 double digit growth for Universal Life. In contrast, for ages 61-70, Term Life and Whole Life grew in the double digits and Universal Life saw double digit declines for ages 61-70 but growth for ages 71+.

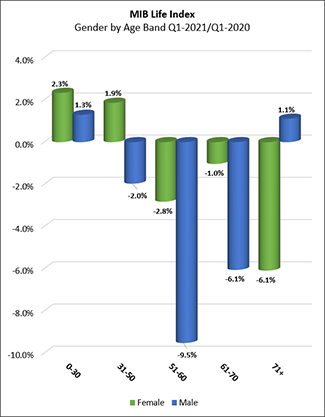

For our Q1 report, we are including an analysis on application activity by gender. Growth in activity was higher for females over males on a YOY basis for March where females were up +8.9% and males +4.3%. On a QOQ basis for Q1, activity among females was relatively flat at +0.9% and declined slightly for males at -2.8%. When looking at age bands, we noticed an increase in application activity among females ages 0-50 for Q1-2021 vs Q1-2020 as well as a slight increase in male application activity for those over age 70. Decreases in application activity were seen among females over age 50 as well as among males for ages 31-70.

About 32% of total Life Index volume for Canada in Q1 did not include a product type. We believe the vast majority of these submissions are for Life Insurance applications and have included them in the composite analysis presented in this report. Missing product type information has a significant impact on Canadian analysis. When looking solely at submissions identified as for Life Insurance products growth is even higher, with activity up +16.1% YOY for Canada in March 2021 and up 9.42% YTD for Q1-2021 over Q1-2020.

Note: Due to frequent missing information regarding the applicant’s country of residence, effective January 2021 we are now identifying Canadian activity based on the company country.

Contact: Betty-Jean Lane, MIB Group, Inc., 781-980-0017, BLane@mib.com